Driving AI Innovation: Shaping the Future of Payments and Customer Strategy with Generative AI

Opportunity

Visa has a long-standing history of leveraging AI, being the first network to deploy AI-based technologies for risk and fraud management in payments 30 years ago. With the rapid advancement and increasing global interest in generative AI, Visa not only wants to capitalize on the exciting opportunity to drive innovation within the payment's ecosystem, but our customers were also looking to us to understand generative AI, it’s applications, and our strategic roadmap. I lead a global, cross-functional team to identify, prioritize, and bring innovative use cases for financial institutions, b2b banking, government, and merchants to life.

Impact

We developed future scenarios for executive briefings, helping clients and partners navigate their AI transformation and positioning Visa as a key partner. In just six weeks, we created animated prototypes to bring these stories to life. This work shaped Visa’s Generative AI roadmap and was presented at multiple executive briefings, focusing on the impact of AI on retail, banking, and government sectors.

Approach

We invited SMEs across the organization to a two-part remote workshop, engaging 46 participants. A small global design team collaborated closely with SMEs to bring use cases to life, leveraging their expertise due to the tight project timeline that didn’t allow for research.

Dynamic Pricing: Enabling merchants to optimize profits, stay competitive, and enhance customer satisfaction by adapting to real-time market conditions

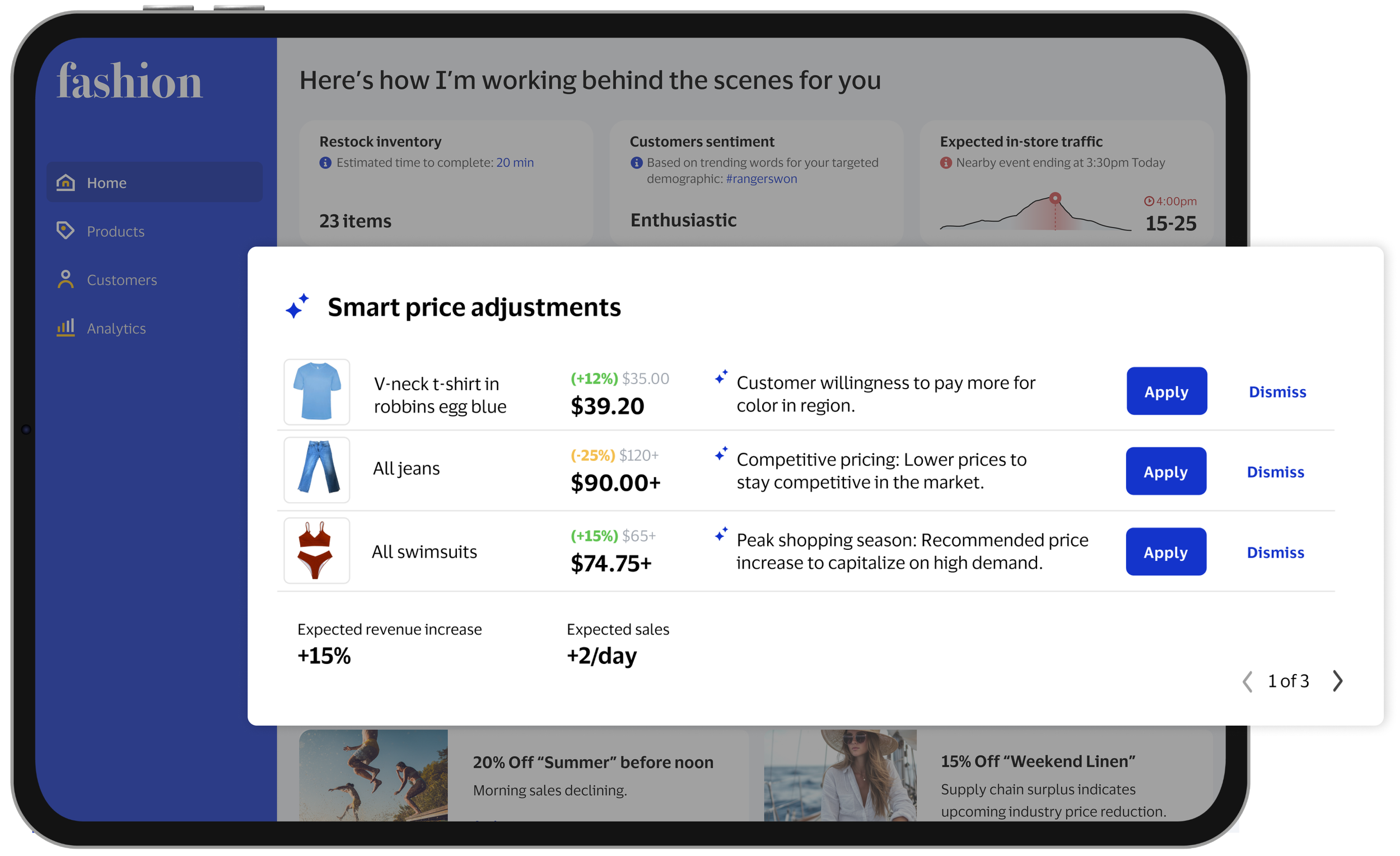

Merchant dashboard highlighting real-time price adjustments to increase profits

Problem: Merchants face significant challenges in setting and adjusting product prices due to fluctuating market conditions, diverse consumer behaviors, and competitive pressures; leading to lost sales opportunities, reduced profit margins, and inefficient inventory management.

Solution: Leveraging generative AI technology to develop a dynamic pricing model that adapts to real-time market data, including consumer sentiment, economic trends, and transaction volumes.

Impact: Enhanced profitability for merchants through optimized pricing, increased competitiveness in the market, and improved customer satisfaction by offering fair and attractive prices.

Tax Monitoring and Fraud Detection: Allowing governments to detect tax evasion, improve compliance, and increase public trust

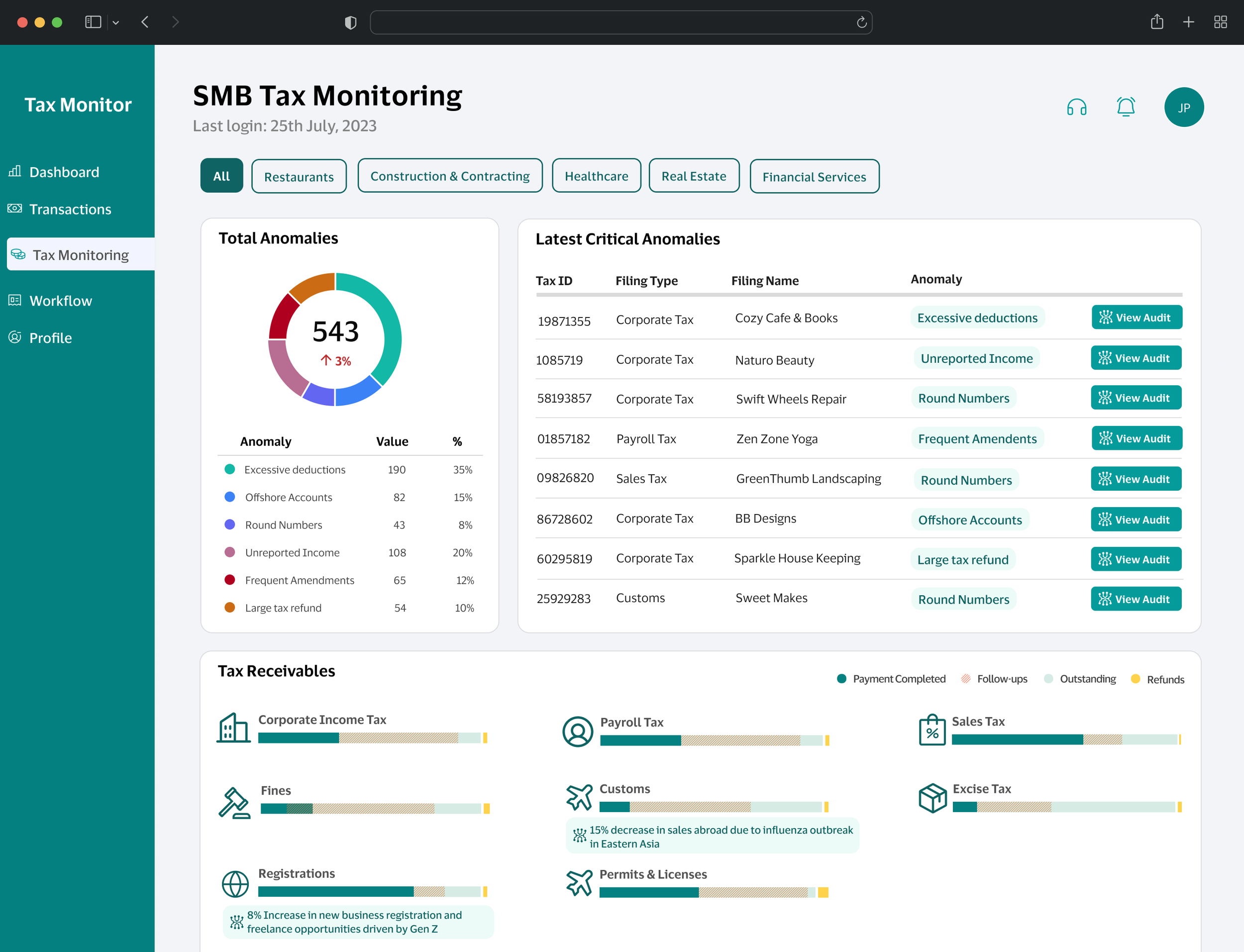

Problem: Traditional tax monitoring systems struggle with inaccuracies and are less effective against new tax evasion techniques, leading to significant revenue losses.

Solution: Generative AI can leverage diverse datasets (transaction data, social media sentiment, search activity trends) to create synthetic data, enhancing the training of tax fraud detection models. This allows for real-time detection and interception of tax evasion activities.

Impact: This approach improves efficiency, accuracy, and cost-effectiveness in tax monitoring, leading to better enforcement of tax regulations and increased public trust in the government's ability to manage tax compliance.

Comprehensive dashboard for government tax monitoring